Medicare Part D Update

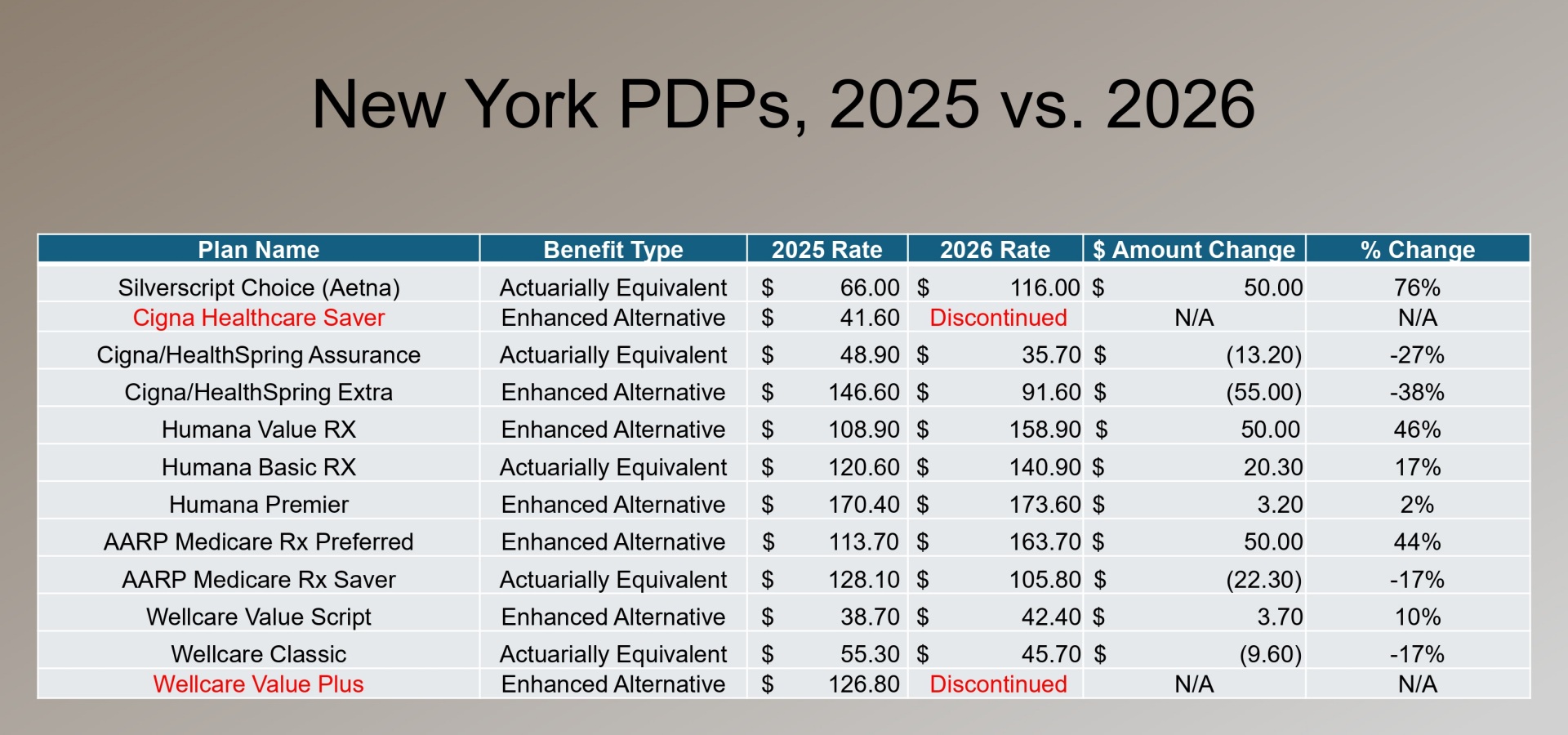

We’re going to use New York City Part D Plan rates for 2026, which are shown below, to extend last month’s discussion. Fortunately, most markets are not as tumultuous as New York.

Please remember that your Part D Plan shopping should align with your primary residence, and rates vary. In some parts of the country, there are still zero premium plans, and this year, for the first time, we see Plans with monthly premiums over $200.

The objective with a Part D Plan is to have all your drugs on the Plan’s formulary, if possible, with the fewest restrictions, have your preferred pharmacy match the Plan’s preferred pharmacy network, and select a quality plan with the least overall expense.

You can view your Plan options on medicare.gov, where you can enter all your prescription medications, their strength and frequency, and your preferred pharmacy.

The good news in New York City is that only three plans have increased premiums by the amount they were allowed to for 2026, which is $50/month. Our concern was that more people taking no drugs or just inexpensive generics might abandon Part D Plans if all premiums increased by $50/month. Thankfully, that concern did not materialize, and there are still affordable premiums. People have very different attitudes about premiums, ranging from those who aren’t at all bothered by paying $50 more a month and those who don’t want to pay any additional amount beyond what they must.

As you can see from the Chart, the variation is quite dramatic in New York with both increases and decreases compared to 2025. Enhanced Alternative plans may provide an out-of-pocket maximum that is less than $2,100, but that depends entirely on your medications. Actuarily Equivalent plans always impose a true $2,100 out-of-pocket maximum. Because drug plan formularies differ, it is impossible to give a blanket recommendation on what plan is best, so everyone needs to look at their specific options.

A final note is that CIGNA sold its Medicare business earlier this year to HCSC, a BCBS parent company, and some of those products are rebranded in 2026 as CIGNA/HealthSpring products. How Cigna/HealthSpring is handling clients who are in products that are being discontinued varies by state, so if you are in a Cigna plan, make sure you are totally clear on how your coverage will be handled if you don’t make an election for 2026. You don’t want to be without coverage if your plan is being discontinued.

If you want to evaluate your options, do so soon. And if you want to change plans, remember that it might affect any prior authorizations currently in effect.

Open enrollment for Medicare Drug Plans is open through December 7th.